U.S. Foundation Moves to Protect Silicon Valley Bank Customers

The U.S. Federal Deposit Insurance Corporation said Monday it had taken steps to protect all depositors at the collapsed Silicon Valley Bank.

The U.S. institution, the bank's receiver, transferred all of the bank's core assets, including uninsured assets, to another bank operated by the institution.

The transferred bank is a national charter bank operating under a board of directors appointed by the Federal Deposit Insurance Corporation.

Tim Mayopoulos was appointed chief executive of Silicon Valley Bank (NA), just as the facility controlled by the foundation is now known.

Mayopoulos was a former president and executive of the National Federal Mortgage Association and most recently served as president of Blind Labs.

Depositors will have full access to their funds from Monday, when the new entity opens and resumes normal business hours and banking activities including online banking.

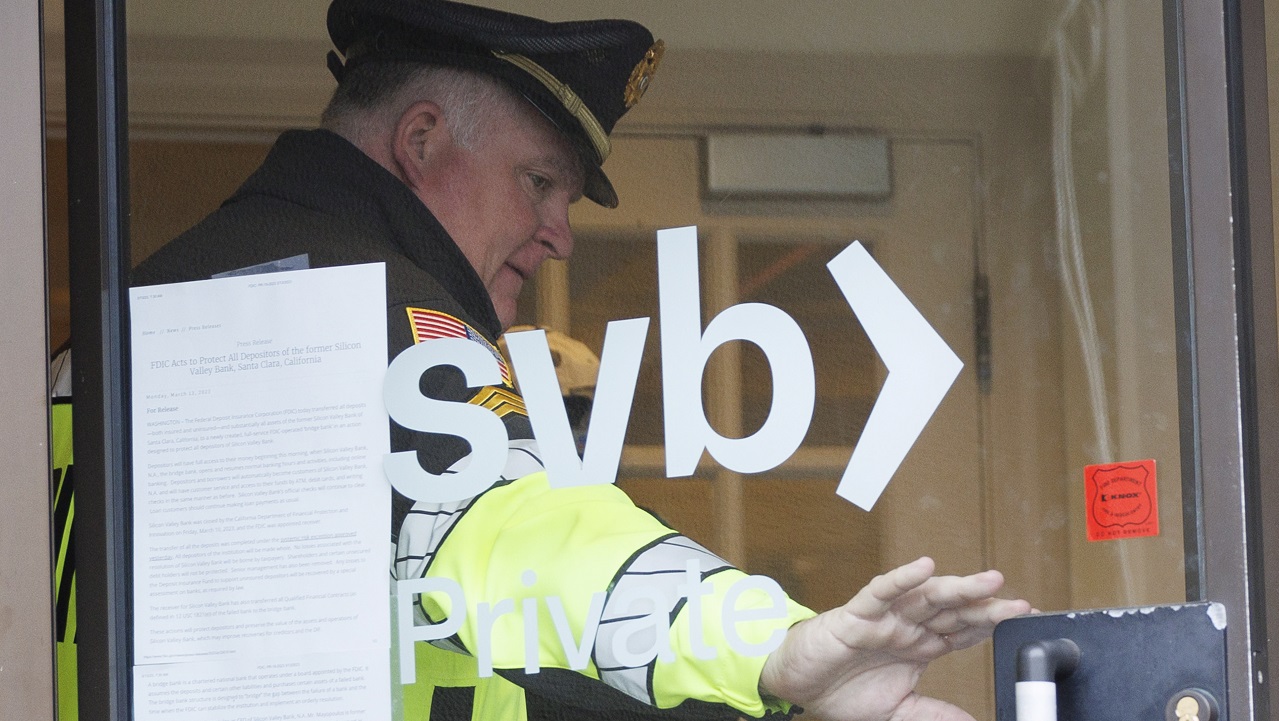

US regulators shut down Silicon Valley after it collapsed, failed to recover financial losses and failed to meet sudden withdrawals by its customers, leading to its bankruptcy declaration last Friday.

It is the biggest collapse of a U.S. bank since the 2008 global financial crisis, which erupted with the bankruptcy of Lehman Brothers.