They had created non-existent companies, for the sole purpose of issuing electronic invoices and centralizing the VAT debt on them. The companies managed by Chinese on the national territory (Prato, Pistoia, Florence, Rome and Venice), collected the proceeds and, transferring the money to the East, made them lose track. The investigations were triggered two years ago.

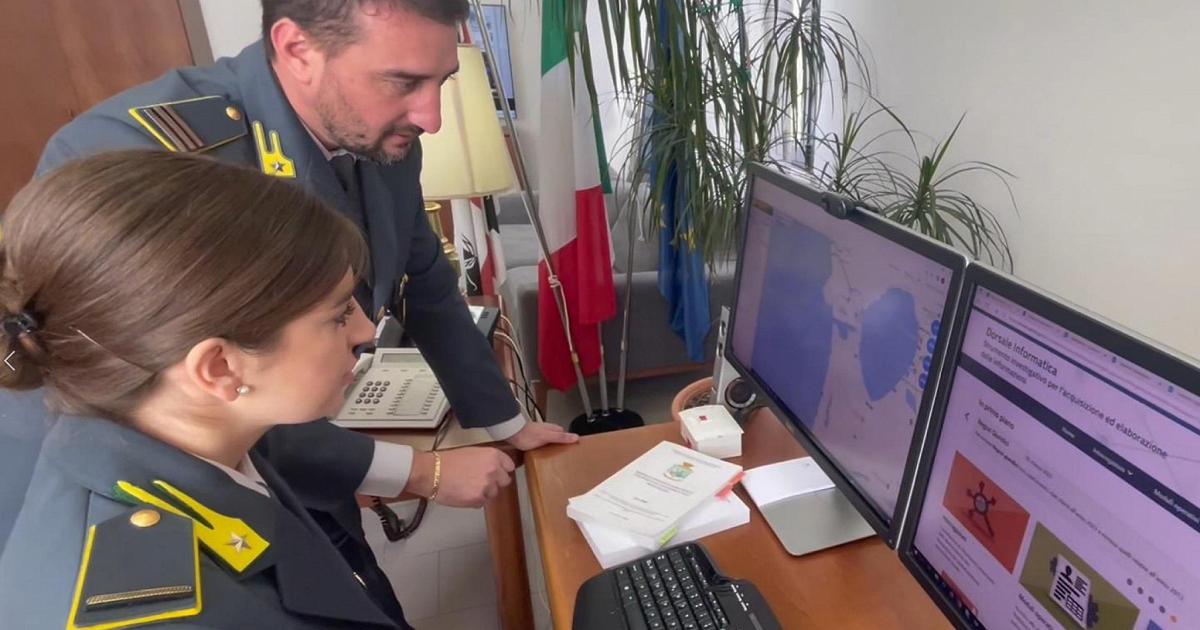

The Guardia di Finanza of Oristano has discovered non-existent transactions for over 200 million euros (evaded VAT for over 37 million), and denounced 19 people, including an Italian tax consultant, for issuing invoices for non-existent operations, failure to declare, unfaithful declaration and self-laundering.

Among the 19 suspects (the Italian consultant residing in the center of the Peninsula and 18 Chinese citizens), there is what the Fiamme Gialle consider the 'dominus' of fraud, the owner of a wholesale company in Oristano that about two years ago closed its activities during the checks. According to what was reconstructed by the investigators, the financial transactions that took place in Sardinia were attributable to him, but also with other suppliers in Prato, Pistoia, Florence, Rome and Venice.

"Many of the economic subjects placed under the magnifying glass - explain the Fiamme gialle - turned out to be "paper mills", in fact non-existent, created for the sole purpose of issuing electronic invoices and centralize on them the VAT debt deriving from the documented operations, omitting the declaration and the consequent payment". Ghost companies opened specifically to issue bogus invoices and closed within two years, before checks could be triggered. The companies invoiced sales for tens of millions of euros in favor of other Chinese residents throughout Italy, collected the earnings and then transferred the money to China making them lose track, then made themselves untraceable.